You are here: Home / Loans & Credit /Promissory Note & Loan Agreement : Details & Sample Templates

Promissory Note & Loan Agreement : Details & Sample Templates

Last updated: August 16, 2016 | by Sreekanth Reddy 147 Comments

A friend in need is a friend indeed. We generally approach our friends or close family members when we are in need of any financial help. We lend (or) borrow money based on mutual trust. Usually these types of loans (hand loans) are unsecured. In most cases, the terms and conditions of a loan are undefined. If the payback(repayment of loan) does not happen, the relationship between the two parties gets strained.

Is there any way to protect the interest of the two parties? Is there any legal document so that you can clearly define the terms and conditions of the loan?

There are two ways of doing this :

You can write a PROMISSORY NOTE (or)You can enter into a LOAN AGREEMENT

Let us understand more about – What are the things to keep in mind before lending money to a family member or a friend? , Why a Promissory Note is important? What is the difference between Promissory Note and Loan Agreement?

What is a Promissory Note?

Promissory note is a written promise to pay a debt. It is a financial instrument, in which one party (maker or issuer) promises in writing to pay a determinate sum of money to the other (the lender), either at a fixed, determinable future time or on demand of the payee subject to specific terms and conditions.

It is of different types-single/joint borrowers, payable on demand, payable in installments or as lump sum, interest-bearing and interest-free.

Things to keep in mind while writing a Promissory Note:

It is governed by Section 4 of the Negotiable Instruments Act, 1881Promissory Note executed in one State may be presented in another State in India with the stamp bearing on the promissory note. No additional stamp duty need to be paidIt should always be in hand written. The agreement must state, in writing, the terms of instrument, extent of liability (amount), maker’s and payee’s name and the amount to be paid, among other things.The promise to re-pay money and no other conditions should be mentioned in PN.When a person issues a promissory note, he/ she would have to stamp it as per the Indian Stamp Act and normally a revenue stamp is affixed on the PN signed by the promissory. You can use Re 1/- revenue stamp and get it cross signed by the borrower.You may also execute the PN note on a Stamp paper if revenue stamps are not available.Try to lend the money by cross A/c cheques. You can mention the cheque details in PN note.PN has a TIME validity. The Pro Note is valid for only 3 years from the date of execution.There is no limitation or ceiling with respect to the AMOUNT.If the borrower pays a part repayment then limitation of 3 years can be from either the date of execution or the last date of payment/acknowledgement whichever is later. The repayments are generally hand written on the back side of PN document (signed by both the parties).PN is generally held by the Lender (Issuer). Once the loan is discharged or fully paid off, it should be canceled and marked as “PAID IN FULL”. And can be returned to the payee (borrower).Witness signature is not required. But it is advisable to get it signed by a witness (a person who is not a party of the note. You may consider getting it notarized as well but it is not mandatory)

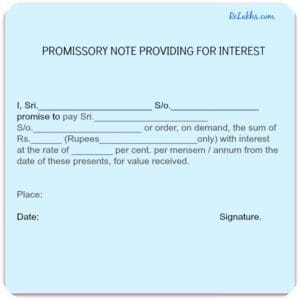

Sample Promissory Note Template :

Download Sample Promissory Note Templates for ” Sample Promissory Note where no time for payment is mentioned”, ” Template for Pro Note made by Joint Promisors”, “Draft P N where repayments are made in installments.”

What is a Loan Agreement?

A Promissory Note lies somewhere between the informality of an IOU (I Owe You) document and the rigidity of a Loan Agreement. An IOU document merely acknowledges that a LOAN exists. A Promissory Note not only acknowledges that there is a Loan but also includes a specific promise to pay.

A Loan Agreement ( Loan Contract)acknowledges that there is a loan, specific promise to pay and also states that the lender has a right to recourse (the legal right to demand compensation or payment). Example can be a FORECLOSURE. If you want to have a right to recourse then go for Loan Agreement instead of a Promissory Note.

A simple Loan Agreement should include the following :

The letter must clearly state “loan agreement” so that it can have legal significance.A Promissory Note only requires the signature of a borrower, whereas the Loan Agreement should include signatures from both parties.It should clearly state how borrower will make the payments. Like at the end of the term, regular periodic payment, regular payments towards interest only (or interest & principal).Terms of payments should be mentioned. How the interest is calculated(Simple/compounding).Loan documents, however, have to be drawn on a stamp paper and notarized. They let you put as many clauses as you want, such as on collateral, default, termination and inclusion of legal heirs.Use full names (as they appear in identity proofs such as PAN/voter I-cards) and mention the date and place clearly.A Loan Agreement can be modified. But a Promissory Note can not be modified. This is the major difference between a Loan Agreement and Promissory Note. Amendments can be carried out either through written confirmation or a supplementary agreement.There is no legal requirement but it is advisable to get the LA document signed by a witness

Loan Agreements are also popular with the financial institutions like Banks, Finance Companies, Gold Loan companies, Home loan (Mortgage)Lenders etc., You may have to generally submit Promissory Note and Loan Agreement to Financial institutions when you acquire loans from them. These loan agreements are very exhaustive and my run into tens of pages.

Simple Loan Agreement Sample / Template:

A Loan Agreement (LA) is like a Promissory Note (PN). A simple LA between two friends can be like a PN Note. But you can include Terms & Conditions especially regarding on the ‘event of default’ and ‘consequences of default.’ But the heading of the document should be clearly mentioned as “Loan Agreement.”

Tax Implications on Loans between Friends/relatives:

Interest free loans are not taxable in the hands of lender or borrower. But if you charge interest rate then interest earned on loan has to be treated as “Income from other sources.” This income should be shown in your (lender) Income Tax Return.

If you borrow money from your friend/relative (non-financial institutions) to construct a house, the repayments (installments) are not eligible for tax deductions. Tax deduction under Section 80c with respect to principal repayment is not allowed.

But Tax benefit under Section 24 of the Income Tax Act can be claimed as Tax deduction with respect to Interest paid on loan. The main criteria is ‘the loan should not be for personal use.’

My opinion on Lending money to Friends or relatives:

As Shakespeare wrote, “For loan oft loses both itself and friend.” If you lend money to a friend or family member, beware that you may not get your money back and your relationship may never go back to normal.Think twice before lending money to a friend. Sometimes its better not to lend money to a friend keeping their best interests in mind.

If you decide to lend money, it is better to have an open and frank discussion about any potential problems or consequences with the loan. If you do not want to lend money, gently refuse the loan and identify the best alternate to help your friend or loved ones. (Read : ‘5 Personal Financial Mistakes that I have committed..!‘)

Would you like to add any suggestions or views on this topic? Please share your comments.

(FYI – RBI has issued a notification on 9th,Sep-2014 regarding ‘Guidelines on willful defaulters.‘ As per this, a guarantor of a willful defaulter can also be treated as a ‘Defaulter. So, think twice before accepting and signing as a guarantor for a loan)

( Image courtesy of anankkml at FreeDigitalPhotos.net)

41236

ReplyDeleteDo you need Personal Loan?

Business Cash Loan?

Unsecured Loan

Fast and Simple Loan?

Quick Application Process?

Approvals within 24-72 Hours?

No Hidden Fees Loan?

Funding in less than 1 Week?

Get unsecured working capital?

Contact Us At :oceancashcapital@gmail.com

Phone number :+16474864724 (Whatsapp Only)

LOAN SERVICES AVAILABLE INCLUDE:

================================

*Commercial Loans.

*Personal Loans.

*Business Loans.

*Investments Loans.

*Development Loans.

*Acquisition Loans .

*Construction loans.

*Credit Card Clearance Loan

*Debt Consolidation Loan

*Business Loans And many More:

LOAN APPLICATION FORM:

=================

Full Name:................

Loan Amount Needed:.

Purpose of loan:.......

Loan Duration:..

Gender:.............

Marital status:....

Location:..........

Home Address:..

City:............

Country:......

Phone:..........

Mobile / Cell:....

Occupation:......

Monthly Income:....

Contact Us At oceancashcapital@gmail.com

Phone number :+16474864724 (Whatsapp Only)

This article is very detailed and meticulous. I have read many articles on this topic, but for this article, you left a deep impression and practical application to my life. Thank you for sharing.

ReplyDeleteLoan Agreement Template

Considering lending money to a friend or family? Protect both parties with a promissory note or loan agreement. For Quick Personal Loans, get Cash In Minutes Provo, South Jordan, Pleasant Grove, Midvale, or Salt Lake City!

ReplyDelete